Compression between Equity Linked Saving Schemes (ELSS) and Public Provident Fund (PPF)

As the investment horizon increases, risk reduces. Equity investment can be very risky for less than 3 years of duration. It is more predictable for above 3 years. But in real life investors make a common mistake of choosing equity for short-term and fixed deposits or PPF for long-term of 15 years or more which should be the reverse case. Persons can get tax exemption under Section 80 C of Income Tax Act 1961 if invested in ELSS popularly known as tax saving mutual funds or PPF.

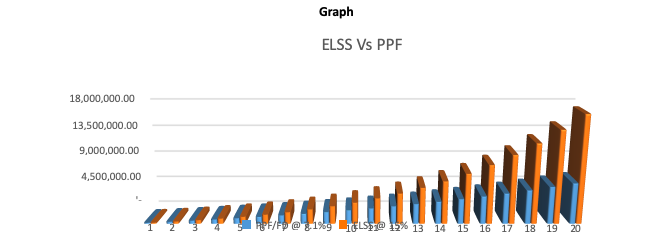

This can be illustrated with the below graph. If an investor invests Rs.150000 annually in both PPF and ELSS fund separately for 20 years, the corpus after 20 years will be Rs 66,58,288/- in PPF while it will be Rs 1,76,71,518/- in an ELSS fund. (rate of returns are taken as 7.1% for PPF and 15% for ELSS. The best performing ELSS fund has delivered over 18-20% CAGR for 20 years). ELSS returns will out-score PPF returns by 1 crore 10 lakhs which is a huge amount. Imagine if the return in ELSS is taken as 18 or 20 % how much it may be? It’s given in the table below.

| Annual Investment (Rs) | Total amount invested in Rs | Total value in Rs from PPF/FD @ 7.1% | Total value in Rs from ELSS @ 15% | Total value in Rs from ELSS @ 18 | Total value in Rs from ELSS @ 20% |

|---|---|---|---|---|---|

| 1,50,000 | 30,00,000 | 66,58,288.17 | 1,76,71,518 | 2,59,53,150.7 | 3,36,03,839.93 |

| Multiples of actual investment | 1 | 2.22 | 5.89 | 8.65 | 11.20 |

By Team Wealth ATM

Visit for financial freedom.

Please feel free to write to us on below mail id for more information and better financial planning. We are always ready to help you.

info@wealthatm.com

Mutual fund investments are subject to market risk. Read the scheme related documents carefully.